Alt or alternative coins: Any cryptocurrency other than the original cryptocurrency, Bitcoin, is known as an alt-coin. Alt-coins range from relatively well-established and popular coins like Ether through to joke currencies like dogecoin. The term is also sometimes applied to stablecoins or to tokens that represent a stake of ownership, such as a security token.

Automated Market Maker: An actor that encourages buyers and sellers in a decentralised market. Like market makers on traditional markets, they aim to make money from discrepancies in pricing on different markets, until the asset price falls into line across all markets. An automated market maker deposits their own pair of cryptocurrencies into a smart contract and lets computer code handle buying and selling with interested parties, who are also using their own smart contracts. Owners of assets are incentivised by sharing in the pool of fees that are generated through trading activity. The process has been compared to YouTube because investors can generate and upload their own content.

Basel Committee on Banking Supervision: The world’s most powerful standards setter for banks. It determines how banks control risks and how much equity they should hold to protect themselves if markets or customers blow up. It has proposed differing digital asset categories for banks wanting to buy and sell crypto for customers or themselves. Banks can treat stock tokens and stablecoins on their balance sheets like existing assets, with some rule modifications. Bitcoin and others would come under a new “conservative” prudential regime, so banks would need to hold at least enough equity to more than cover all potential losses.

Binance: By some measures, the world’s largest unregulated cryptocurrency exchange. Founded by Changpeng Zhao in 2016, it claims not to have a headquarters but has semi-autonomous units operating around the world. Regulators, globally, are scrutinising the company and some have already barred it from their jurisdictions. However, users have still been able to access its website.

Bitcoin: The biggest and original cryptocurrency that launched an entire industry. It was envisaged by its pseudonymous creator (or creators) Satoshi Nakamoto as a “peer-to-peer electronic cash system”.

BNB coin: The cryptocurrency of the exchange Binance. It was launched in 2017 with the promise that only 200mn tokens will ever exist. Every quarter, Binance uses a fifth of its profits to destroy already existing coins, in a bid to make them more scarce and in turn, more valuable. The coins can be used to pay for Binance services, to pay trading fees, or for trading — just like Bitcoin and others.

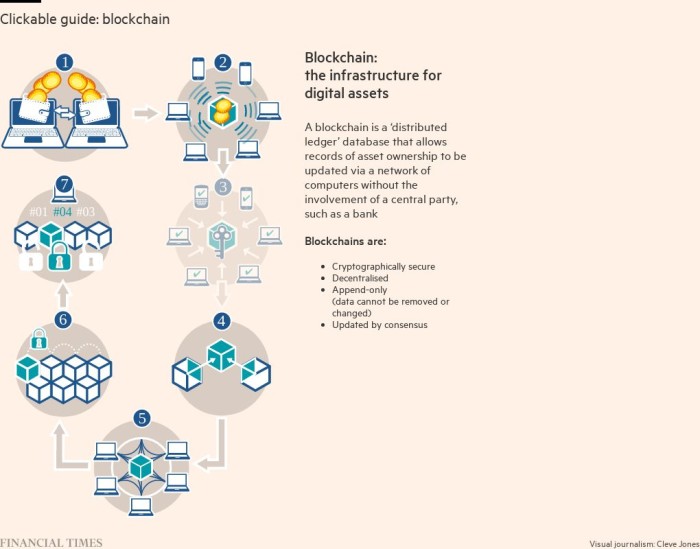

Blockchain: A type of distributed ledger, written on open source software. It is a growing database of time-stamped transactions that cannot be altered. Each new transaction is verified by a network of computers and added as a “block” to the chain.

Burning coins: Inflation is one of the enemies of cryptocurrencies. Thus, there is a counterpart to minting new coins: burning them, thereby removing them from circulation. For stablecoins, burning is particularly important to keep the token supply equal to the asset backing they have.

Cardano: A blockchain network that can facilitate peer-to-peer transactions with its own digital currency, Ada. The name honours English mathematician and writer Ada Lovelace, who is viewed as the world’s first software engineer because she created an algorithm in the 19th century. It promises to use less energy than Bitcoin or ethereum because it uses proof-of-stake protocols to verify transactions. It was developed by Charles Hoskinson, a co-founder of ethereum, who left after a dispute with other fellow co-founders, including Vitalik Buterin. Cardano’s Ada is one of the fastest growing cryptocurrencies, with more people holding it on trading platform eToro than Bitcoin.

Central bank digital currencies (CBDCs): Proposed digital currencies run by central banks, rather than created by private companies. They would use the same technology but would be backed by reserves. Central bankers have been spurred on by fears that efforts such as Facebook’s proposed cryptocurrency could impact monetary policy, and destabilise financial markets or cross-border money transfers.

Coin: A cryptocurrency that lives on its own independent blockchain. Examples include Bitcoin and ether. Distinct from a token.

Coinbase: The largest US listed exchange for buyers and sellers of cryptocurrencies and tokens. Customers can also deposit their crypto assets with the exchange and lend them out, earning interest far in excess of prevailing bank rates.

Cold storage: Storing crypto assets on a computer in a vault, which is not connected to the internet. Many cold storage wallets do not accept as many kinds of cryptocurrencies and are more expensive storage options. Consequently, many traders prefer to use a hot wallet.

Commodity Futures Trading Commission (CFTC)

The main US regulator for derivatives. The agency has determined that, in legal terms, virtual currencies like Bitcoin are commodities. That means it has jurisdiction to oversee derivatives that use a digital currency and potentially hand out penalties if there is fraud or manipulation of those derivatives.

Cryptocurrency: A currency created digitally, usually by private companies, and named after the cryptographic maths that make it possible. It was conceived in the depths of the financial crisis by Satoshi Nakamoto as a way for people to make electronic payments without going through any financial institutions.

Crypto exchange: A venue for buying and selling cryptocurrencies such as Bitcoin and ether. They often also offer loans and custody of assets, and other services that a traditional exchange cannot. Examples of crypto exchanges include Binance, Coinbase, Huobi, Bybit, Kraken, Gemini, Bitfinex and Bitstamp.

DApp: A computer application that runs on a decentralised finance network, such a distributed ledger.

DAO (decentralised autonomous organisation): An organisation whose rules are automated or developed by consensus among the members. It is designed to work unlike a typical corporate structure, where power lies in the hands of an executive or board.

Decentralised finance (DeFi): An umbrella term for a collection of cryptoasset projects that aim to do away with a centralised intermediary — like a bank or an exchange — to provide financial services. They use DApps to execute common services like lending, savings accounts and trading coins.

Decentralised trading protocol: Sometimes referred to as a decentralised exchange, or DEX. It is a network that allows users to buy and sell digital assets directly with each other, bypassing intermediaries that might impose fees, such as an exchange or clearing house. Automated market makers use smart contracts which can trade 24 hours a day, seven days a week. Older trading networks, such as Uniswap and SushiSwap, are written on ethereum but newer networks like Pyth may use alternative protocols like Solana or Polkadot. However, some networks may suffer from low liquidity. There is also little recourse for users who find their security hacked and assets stolen.

Diem: The yet-to-be launched digital coin by Facebook and previously known as Libra. It has been credited with jolting central banks and regulators into realising that private cryptocurrency initiatives were becoming too big to ignore, and to start on their own CBDCs. The intense scrutiny led Facebook to change the name from Libra and scale back its ambitions in 2020.

Digital Currency Group: Venture capital firm that has funded dozens of projects, such as investment firm Grayscale, exchange Coinbase and broker eToro.

Distributed ledger: A public register of deals shared and replicated by a network of computers. They work together to verify transactions and create an immutable ledger, and do away with the need for a central authority. It is similar to a blockchain but it does not need to have its data structured in blocks. Nor does it need to use proof of work to mine tokens.

dogecoin: An alt-coin that purposely began as a joke, to highlight the speculative nature of cryptocurrencies in 2013. It uses a Japanese Shiba Inu dog as its mascot and has surged in popularity and value despite its beginnings.

Ether: The world’s second most actively-traded cryptocurrency and the token associated with ethereum.

Ethereum: A developer-run blockchain technology co-founded by Vitalik Buterin, a Canadian-Russian computer science student. Its aim is to make blockchains more useful and revolutionary than simply to serve as a database for transactions. Its technology can hold assets, enables programmers to code functions for buying and selling into smart contracts, and is typically also the building block for most DApps for finance.

Fiat currency: A traditional currency backed and regulated by a central bank — such as the US dollar, euro, sterling and yen.

Flippening: A term the moment when ether overtakes Bitcoin as the biggest and most valuable cryptocurrency.

Fork: Developers sometimes disagree on how a blockchain should be run and, if they cannot settle their differences, the ultimate step is to create a fork in the network. One side will use newer software and the existing network will rely on the older version. It means that two incompatible versions of the blockchain emerge, based on different principles and with different user bases. Forks can take place for a number of reasons including concerns over outdated and insecure software, or a need to reverse the log of transactions following a hack, or a need to return investors’ funds to them.

FTX: A fast-growing Hong Kong based cryptocurrency derivatives exchange founded in 2019 by former trader Sam Bankman-Fried.

FUD: An acronym for “fear, uncertainty and doubt”, used as a dismissive label for negative information about cryptocurrencies — and normally to imply that criticisms of digital assets are invalid or misleading. The Fud label is often applied to critiques focusing on Bitcoin’s environmental impact or the use of cryptocurrencies for money laundering. People who spread Fud are called Fudsters.

Gas Fees: The fees paid by users to compensate for the amount of computing energy needed to verify a transaction on the ethereum network. They are intended to prevent nefarious actors from spamming the network. Prices can rise and fall depending on demand. Users have complained about ethereum’s fees, which can cost anything from $20 — $100, because ethereum is so heavily used.

Gemini: An exchange for buyers and sellers of cryptocurrencies and tokens set up in 2014 by the Winklevoss twins. Customers can also deposit assets and earn interest far in excess of prevailing bank rates.

Governance tokens: Tokens that give holders voting powers on a blockchain protocol. They are mainly used in DeFi projects so systems can remain decentralised and no one party makes the decisions on the project’s future direction.

Greyscale Investment Trust: A fund that operates the world’s most popular Bitcoin exchange-traded fund.

Have fun staying poor: The ultimate retort from crypto enthusiasts to sceptics — expressing their pity for non-believers. It is usually used to counter criticism of Bitcoin or other digital assets and it implies that sceptics do not understand the full implications of blockchain technology.

Hodl: The battle cry of the long-term cryptocurrency holder. Originally a humorous misspelling of ‘hold’ found on a cryptocurrency forum in 2013 and sometimes thought to be an acronym for “Holding On For Dear Life”, the frantic tone associated with its use has struck a chord with the wider crypto community. Hodling is…